No one ever said starting a business was easy, but making the right decisions at the outset can make it a much easier process. If you’re considering starting a business in the UK, one of the first things you’ll need to decide is which business structure to adopt.

Choosing the right business structure is an important decision for any business owner. The implications can be far-reaching, affecting everything from liability to taxation. Choosing the wrong business structure can result in legal issues, limited investment opportunities and higher taxes, so picking the right one is vital.

This guide will help you understand the different business structures in the UK. We’ll go into detail about the pros and cons of each structure, so you can make an informed decision about what’s right for your business. Plus, we’ll give you some tips on how to register your business in the UK. So, whether you’re just starting out or looking to switch structures, this guide has everything you need.

Jump to what you’re looking for:

- An Overview of UK Business Structures

- Sole Traders

- Partnerships

- Limited Liability Partnerships

- Private Limited Company

- Public Limited Company

- How to Choose the Right Business Structure for Your Business

- Start Your Business with Mint Formations Today.

An Overview of UK Business Structures

When you start a business in the United Kingdom, you have several options for business structures. The most common structures are:

- Sole proprietorships

- Partnerships

- Limited companies.

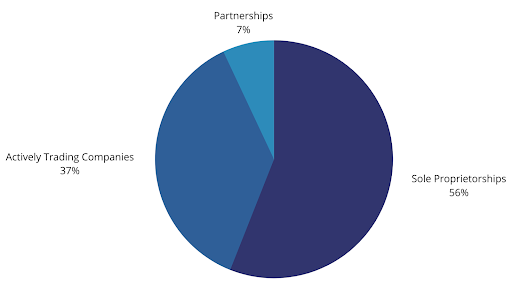

According to the latest figures from the UK Government, there are currently around 5.5 million private sector businesses in the United Kingdom. Of those, 3.2 million are sole traders, two million are active companies, and 384,000 are partnerships.

Alongside these structures, there are less common structures in the UK, such as unlimited companies and social enterprises, predominantly used by charities and non-profit organisations. Each type of business has its own legal and tax rules, so it’s important to choose the right structure for your business.

Sole Trader or Sole Proprietorship

In the United Kingdom, a sole trader or sole proprietorship is a business owner who is not legally considered a separate entity from their business. This type of business structure is the simplest and most common way to start a business in the UK.

As a sole trader, you’re self-employed and responsible for all aspects of your business, including its debts and liabilities. The main advantage of being a sole trader is that you have complete control over your business. However, this also means you are personally liable for any losses incurred by your business.

Another downside is that it can be challenging to raise capital, as potential investors may be reluctant to invest in a business with such high personal risk.

If you decide to become a sole trader in the UK, you must register with HMRC and keep accurate financial records. You must also file a self-assessment tax return annually to pay income tax and national insurance.

While being a sole trader may not be suitable for everyone, it can be an excellent way to start your own business with relatively low startup costs and red tape.

Sole Trader Responsibilities

There are a few key things to remember if you’re operating as a sole trader in the UK:

- You’ll need to register with HMRC and file a self-assessment tax return each year. This is relatively straightforward — you can do it online or through the post.

- You need to keep accurate records of your income and expenses, which will make it easier to complete your tax return accurately.

- You need to pay any taxes that are due on time.

You may be liable for interest and penalties if you don’t meet your responsibilities as a sole trader. If you have any questions, HMRC’s website is a good place to start. They have a lot of helpful information and resources available.

Alternatively, check out our blog, where there are resources on all aspects of being a sole trader, and our team are always happy to help.

Advantages of Being a Sole Trader in the UK |

Disadvantages of Being a Sole Trader in the UK |

|

|

How to Register as a Sole Trader

In the UK, anyone who wants to start their own business as a sole trader can do so by registering with HMRC. This can be done online, by phone or by post. The first step is to provide HMRC with some basic personal information, such as your name, address and date of birth.

Once you have completed the registration process, you will be issued a Unique Taxpayer Reference (UTR). This will be used on all correspondence with HMRC regarding your tax affairs.

Registering as a sole trader is relatively straightforward and only takes a few minutes. HMRC provides clear and concise guidance on its website, and plenty of helpful information is available from other sources.

One of the quickest ways to register as a sole trader is to use a company formation agent who will take care of the registration for you. So if you’re thinking of starting your own business in the simplest way, register as a sole trader today.

Register as a sole trader today.

Business Partnership

Business partnerships are a popular way to set up and run a business in the UK. In a partnership, two or more people come together to share the risks and rewards of running a business. Business partnerships can take many different forms, from large companies with hundreds of partners to small firms with just a couple.

In many ways, being in a partnership is similar to being a sole trader, as you are personally responsible for the business’s debts and expenses. The big difference is that you share that responsibility.

The key advantage of a partnership is that it allows businesses to pool resources and expertise. This can help them access new markets, finance new products and tap into new pools of customers.

However, partnerships can also be complex and difficult to manage, especially if they involve different types of partners with different interests. For this reason, it’s crucial that partners clearly understand their roles and responsibilities before entering into a partnership agreement.

Business Partnership Responsibilities

If you’re a partner in a business partnership, you will need to:

- Register with HMRC and file an annual self-assessment tax return. Each partner pays tax individually and is responsible for their own self-assessment tax return and paying income tax.

- Pay any taxes that are due on time.

- Complete a Partnership Return, showing each partner’s share of profits and losses

- Keep accurate profit and loss records.

It’s important to ensure you meet your responsibilities as a partner. Failure to do so can result in fines from HMRC.

Advantages of a Business Partnership in the UK |

Disadvantages of a Business Partnership in the UK |

|

|

How to Register a Business Partnership

Before you can register a business partnership in the UK, there are some important things you need to do. First, you need to choose a business name and ensure it’s available to use. You can do this by searching the Companies House website or our company name checker.

Once you’ve chosen your business name, you’ll need to choose a “nominated partner”. A nominated partner is responsible for maintaining company records and ensuring tax returns are filed.

The final step in registering your business partnership is to register it for self-assessment with HMRC. This will be done by the nominated partner, and they will be responsible for sending the annual company tax return. All other partners will need to personally register for self-assessment tax individually.

Limited Liability Partnership (LLP)

A limited liability partnership (LLP) is a specialised business structure that offers some of the benefits of both a traditional partnership and a limited company. An LLP is composed of two or more partners, each of which has limited liability for business debts and obligations. This means that if the LLP becomes insolvent, the partners’ personal finances and assets are protected from seizure.

In addition, an LLP provides a flexible framework for structuring business relations among the partners. For instance, partners can agree to share business profits and losses in any proportion they choose. As a result, an LLP can be an attractive choice for businesses that want to enjoy the benefits of both partnerships and corporations.

Limited Liability Partnership Director Responsibilities

If you are the director of an LLP, you will need to:

- Maintain accurate accounting records

- Prepare, sign and file accounts with Companies House

- Appoint an auditor (if required)

- Keep the statutory register up to date (e.g. Persons with Significant Control)

- Submit a confirmation statement to Companies House

- Inform Companies House of any company changes.

As a director, you must ensure that you comply with all your responsibilities to avoid fines and potential criminal charges from Companies House and HMRC.

Advantages of a Limited Liability Partnership in the UK |

Disadvantages of a Limited Liability Partnership in the UK |

|

|

How to Register a Limited Liability Partnership

The first step in registering an LLP is to choose a company name. Your chosen name cannot be too similar or the same as another registered company. You can check this through Companies House or by using our company name checker. Your company name must end in “Limited Liability Partnership” or “LLP” and cannot contain offensive terms.

The next step is to choose your registered office address. Your registered address will be where Companies House will send all official correspondence and needs to be:

- A physical address

- In the same country as your LLP is registered.

You can use your home address if you do not have an office address. Many directors prefer to use a virtual office address for their registration rather than their home address as it protects their privacy.

Virtual office addresses provide companies with a physical address for correspondence that will be forwarded to your personal address. You can also use a director’s service address to avoid your personal details being available on the public register.

The final step is to register your LLP with Companies House. You can register the company electronically or by post, or use a company formation agent to handle the registration for you. Using a company formation agent takes the stress out of registering and gives you peace of mind that your registration will be successful.

Register your limited liability partnership today.

Private Limited Company (Ltd)

In the United Kingdom, a private limited company (Ltd) is a business that’s a separate legal entity from its shareholders. Limited companies are businesses that have shareholders, but the shares cannot be sold to or bought by the general public. Private limited companies must have at least one director and one shareholder, but there’s no limit to the number of shareholders they can have.

Limited companies can either be “limited by guarantee” or “limited by shares“. A private limited company has limited liability, which means the liability of the shareholders is limited to the amount of money they have invested in the company.

If you want to set up a private limited company in the UK, you need to register it with Companies House. You will also need to create a “memorandum of association” and “articles of association”. These documents state what kind of business you are setting up and how you will run it. You will also need to pay a registration fee. Once your company is registered, you will be able to start trading.

Private Limited Company Director Responsibilities

As the director of a private limited company, you are responsible for:

- Following your company’s rules as outlined in your articles of association

- Keeping accurate company records

- Reporting any significant changes to Companies House

- Filing your company accounts and annual tax return

- Informing shareholders of any potential personal benefits of business transactions

- Paying corporation tax.

Advantages of a Private Limited Company in the UK |

Disadvantages of a Private Limited Company in the UK |

|

|

How to Register a Private Limited Company

The first thing you need to do to register a private limited company is to pick a company name. As with LLPs and ordinary partnerships, the name cannot be in use by another company, too similar to an existing company or offensive.

Next, you’ll need to put together certain documents for Companies House. The first document to prepare is your “memorandum of association,” which outlines the basic information about your company. Next, you will need to draft your company’s “articles of association,” which set forth the rules and regulations governing your company’s internal affairs.

Once you have these documents in order, you can submit them to Companies House and pay the registration fee. Once your company is registered, you will be required to file annual reports and accounts with Companies House. In addition, you will need to comply with all applicable laws and regulations.

Registering a limited company is a relatively simple process, but it’s important to ensure you understand all the requirements before getting started. One of the easiest ways to register a limited company is to use a company formations expert.

Register your private limited company today.

Public Limited Company (PLC)

A public limited company (PLC) is a type of limited company listed on the stock exchange. This means that anyone can buy shares in the company. A PLC must have a minimum share capital of £50,000 and at least two directors.

One of the advantages of being a PLC is that it can raise money by selling shares to the public. This can be useful if the company needs to expand or if it wants to pay off any debts. Another advantage is that a PLC has limited liability. This means that the shareholders will not be held responsible if the company goes into debt.

However, there are also some disadvantages to being a PLC. For example, the company is required to disclose its financial information to the public. This can be a disadvantage if the company wants to keep its financial affairs private. In addition, a PLC is subject to more regulation than a private limited company.

Public Limited Company Responsibilities

As a director of a public limited company, your responsibilities include:

- Ensuring your company has at least two directors and a qualified company secretary

- Sending an annual return to Companies House

- Maintaining all company records

- Filing accounts with Companies House every year

- Ensuring your company accounts are professionally audited (unless exempt)

- Paying corporation tax.

Advantages of a Public Limited Company in the UK |

Disadvantages of a Public Limited Company in the UK |

|

|

How to Register a Public Limited Company

Before you register your public limited company, you need to double-check that you meet the following requirements:

- You have at least two shareholders

- You have at least two directors and a qualified secretary

- You have a minimum share capital of £50,000.

As with almost every business structure, the first thing you need to do to register a public limited company is to pick a name. You’ll need to ensure the name is available, not too similar or the same as an existing company and isn’t offensive. You can use our company name checker to see if your business name is available.

Next, you’ll need to put together your memorandum and articles of association. These documents outline how your company will run. They include details on how decisions are made, director responsibilities and how you can appoint and remove directors. While you can put together your own incorporation documents, it’s always a good idea to consult a professional.

With your documents ready, you can file them with Companies House and complete your application. This can be done online or by post. We’d always recommend applying online as the process is much faster.

The final stage in registering a public limited company is to apply for a trading certificate. Before you can start trading as a PLC, you must have a trading certificate from Companies House that confirms you meet the share capital requirements.

How to Choose the Right Business Structure for Your Business

When starting a business, one of the first decisions you’ll need to make is what type of business entity to establish. This is a daunting decision as it will impact a number of factors, including your personal liability, your corporation and income tax obligations, and the amount of official paperwork required to keep your business up and running.

Hopefully, our guide has helped you to understand the different business structures in the UK, but if you’re not sure where to start, here are some things to consider that might help you make a decision:

- Do you want to be personally liable for business debts?

- Do you want shareholders or to run the business on your own?

- Do you want to share responsibility and liability with a partner?

- Do you want to start simply and change the structure later on?

It’s important to remember that although your business structure is important, it’s not permanent. Many entrepreneurs in the UK start as a sole trader and become a limited company at a later date. The process of changing your business structure is usually straightforward, and if you’re unsure, you can hire a formation agent to handle everything for you.

Start Your Business with Mint Formations Today

Ready to start your own business? If so, Mint Formations can help. We specialise in helping people register their businesses. We’ve helped thousands of people get their businesses off the ground, and we can do the same for you.

Company registrations are easy with Mint Formations. We can help you every step of the way, from choosing the right business structure to filing the necessary paperwork. We’re here to make starting your own business as easy as possible.

Register your business with Mint Formations today and get free lifetime support from our lovely team. If you have any questions, get in touch with us today, and we’ll do everything we can to help.